Revenue Based Financing

Revenue-based financing is a type of funding in which a company agrees to share a percentage of future revenue with a lender in exchange for capital up front. The loan payments can be tied to monthly revenue, and contracts.

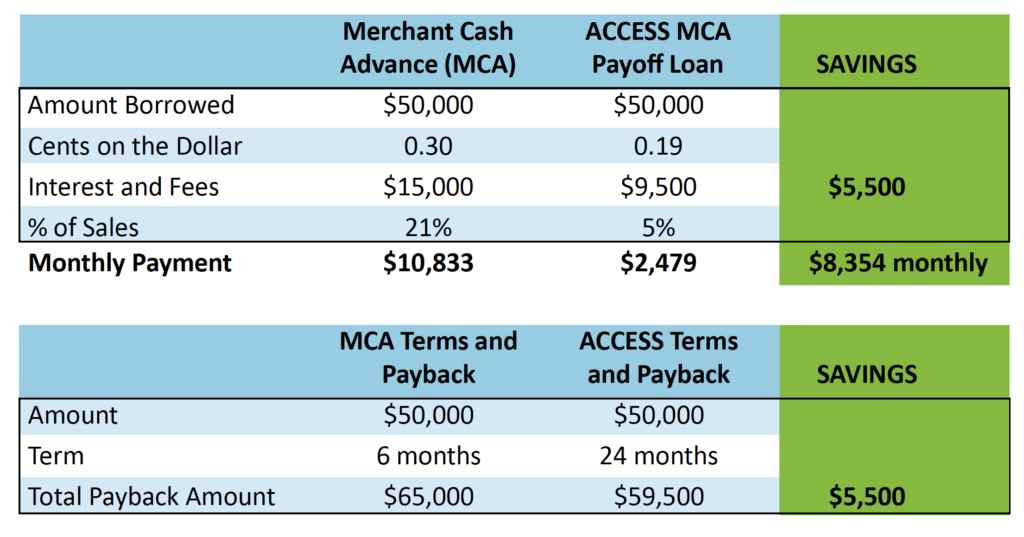

Refinance High Interest Debt and Immediately Improve Cash Flow with Rates Less than 9%

Access to capital has historically been a major challenge. However today more than ever predatory lending is prevalent in the small business lending market.

What is Revenue Based Financing?

Revenue-based financing is a type of funding in which a company agrees to share a percentage of future revenue with a lender in exchange for capital up front. The loan payments can be tied to monthly revenue, and contracts.

Delivering exceptional services to our valued clients

Allow ACCESS to pay off high interest rate Merchant Cash Advance Loans. Extend the term of your loans and reduce the interest rates on your business debt.

Established businesses can use the ACCESS Revenue Based Financing program to support their financing needs. If your business has a break-even or positive cash-flow, and a history of paying its debts, then you’re a good candidate for the ACCESS Revenue Based Financing. To be considered for automatic approval, you must meet the following requirements:

- One or more years in business

- Business has cash flow that’s positive or break-even

- Copy of MCA agreement

- More than $120,000 in annual revenue

- No liens or judgments filed for you or your business within the last 3 years

- Business and owner have no prior bankruptcies

Even if you don’t meet some of the requirements above, give us a call. You can still work with ACCESS to reach your goals. Find out if you’re eligible for our free business advisory services, which can help you improve your business’s financial picture for the future.

Here is how you save money

What can you use a Revenue Based Financing for?

You can use the ACCESS Revenue Based Financing facility to pay off high interest rate Merchant Cash Advance Loans. Extend the term of your loans and reduce the interest rates on your business debt.If you are looking for revenue based financing as a way to increase your business cash flow, please start an application or contact us.